Contents:

- What are commodity codes?

- Which tariff to use?

- How to find a commodity code

- How to find or check a commodity code in the UK Tariff

- Having trouble finding the correct commodity code?

- What if I get the commodity code wrong?

What are commodity codes?

These may also be referred to as:

- Harmonised System Codes (HS Codes) = first 6 digits of a commodity code, used worldwide.

- Tariff Headings / Codes

- CN or Classification Codes

Commodity codes are a globally recognised means of identifying imported and exported items for Customs purposes. UK imports are classified to all 10 digits of the commodity code while exports are classified to the first 8 digits only. In conjunction with an imported item's Country of Origin (COO) and customs valuation, it is used to determine what level of customs duty is payable, whether to apply Rules of Origin and what regulatory requirements exist. Identifying the correct commodity code is crucial.

Which tariff to use?

The UK Tariff lists UK import duty, VAT and Excise rates and other import/export information, including, import and export controls, preferential and non-preferential rules of origin and rates and chapter notes to assist classification.

How to find a commodity code

Customs agents, suppliers and advisers may be able to help, but the legal liability for applying the correct commodity code sits with the entity whose name is on the import documentation (“the importer of record”.)

It is important that you are satisfied the commodity code is correct, especially for large value items or items you import regularly because this dictates any tax liability and import/export controls. The screenshots below explain how a commodity code can be checked in the UK Tariff.

Finding commodity codes for imports into or exports out of the UK is worth referring to if you are having difficulties identifying a commodity code. It includes a link to guidance on a variety of goods that are hard to classify, including:

- computers and software

- audio and video equipment

- plastics

- pharmaceutical products

- organic chemicals

How to find or check a commodity code in the UK Tariff

Link: UK Tariff Lookup

- Contact the supplier of the goods and ask them for the commodity code. If the HS Code is provided this will consist of 6 digits, which will be the start of the UK commodity code.

- You should always check the Commodity Code using the UK Integrated Online Tariff, especially for purchases of a significant value.

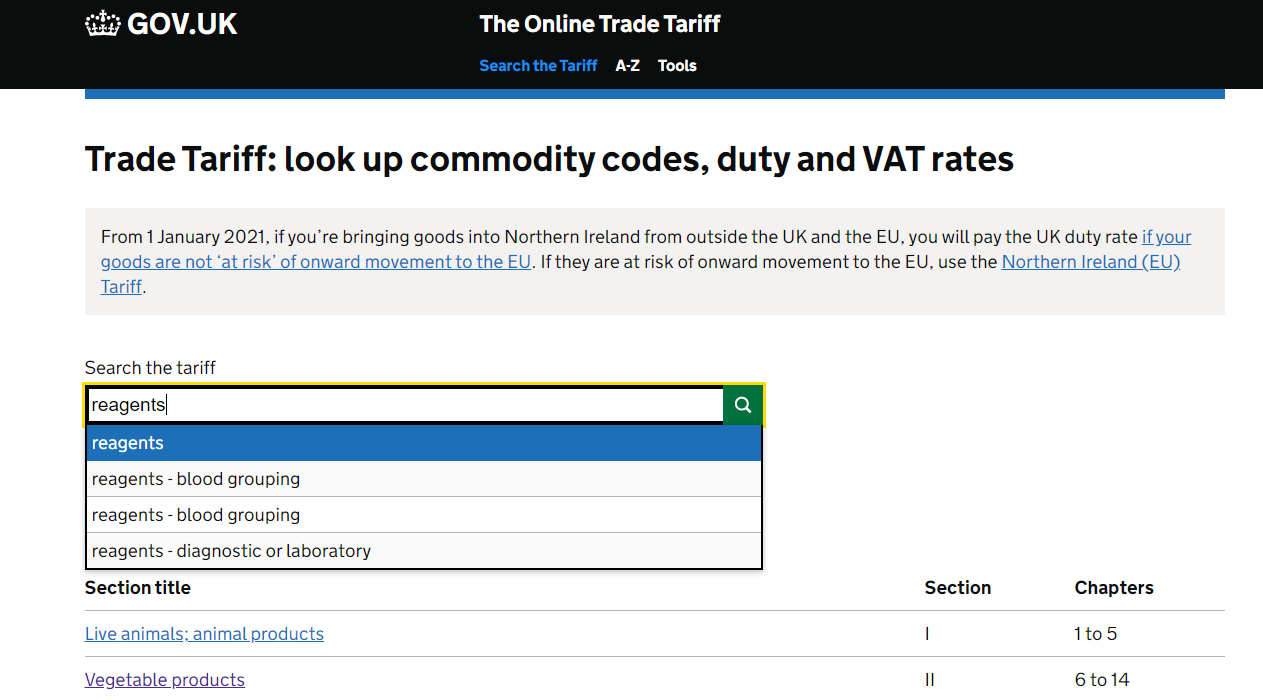

- Click on the UK tariff and click on “Start now”. Type either a description of the goods or the commodity code (or a part of the commodity code) into the search bar, to see the various options available. You also have the option to scroll down to look at the sections or use the A-Z tab.

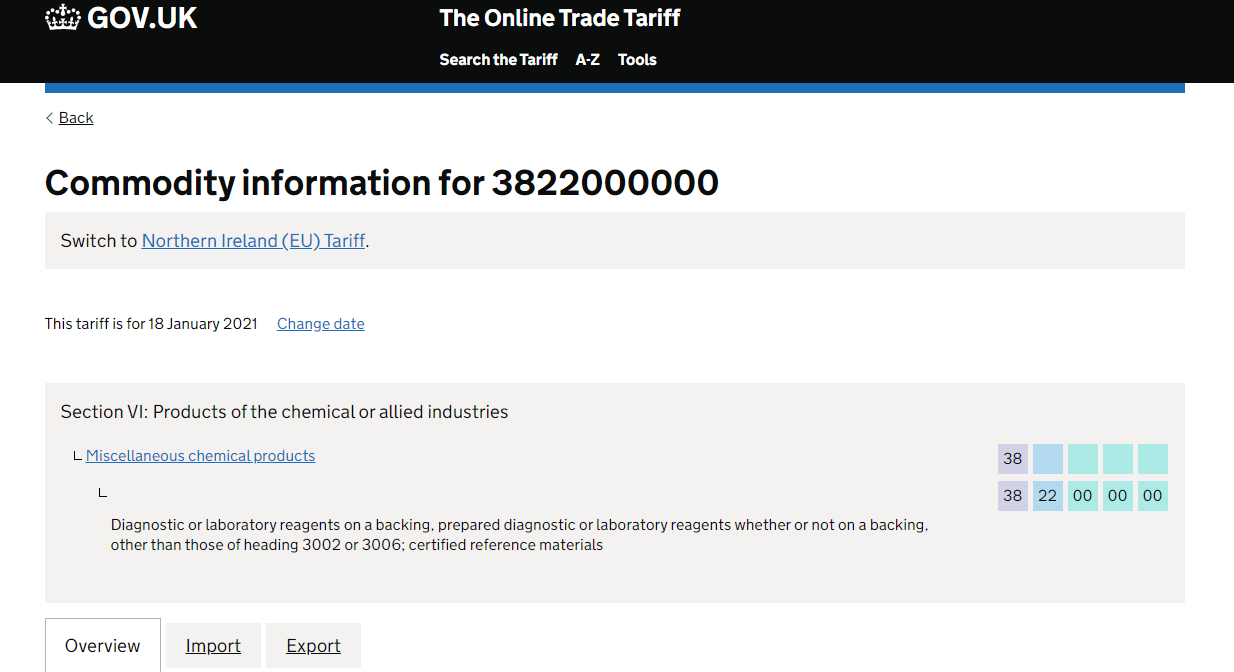

Select the relevant option – you may need to click on several layers until you find the relevant sub-codes.

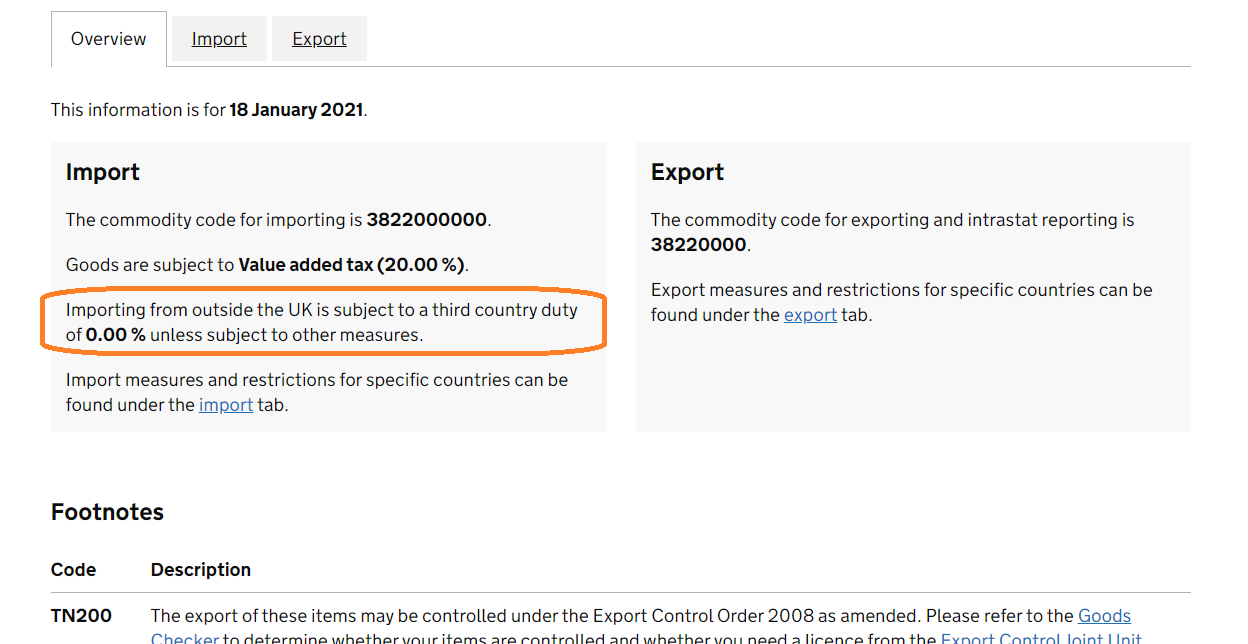

Scroll down to see the applicable rate of duty on import into the UK:

- Click on the import tab, find the country the goods originate from or are going to, and see if any special measures/restrictions are in place.

Having trouble finding the correct commodity code?

Look again at Finding commodity codes for imports into or exports out of the UK.

Search for products by reference to the material they are made from, can help e.g. PPE gloves are in the ‘Rubber’ section.

If you cannot find the right commodity code for your goods, you can contact HMRC for advice or for a decision on your goods. You can do this in two ways:

- Informal advice - HMRC’s Tariff Classification Service aim to respond within 5 working days. Use this method for a quick and informal decision, which is not legally binding.

- Advance Tariff rulings from HMRC – a formal legally binding decision can take between 30 and 60 days to be processed and is likely to require specialist advice.

Alternatively, contact the Import Export Hub for assistance and we can help you to obtain a quote for external advice.

What if I get the commodity code wrong?

HMRC uses the codes to work out how much customs duty or import VAT we owe on goods that are moving in or out of the UK. They also provide information on required licenses and certificates so, if you use the wrong code:

- Your goods could be delayed or seized

- You might pay the wrong amount of customs duty or import VAT (and have to pay extra charges if you have paid too little)

- You might incur Customs penalties and fines